Get the free form otc 901

Show details

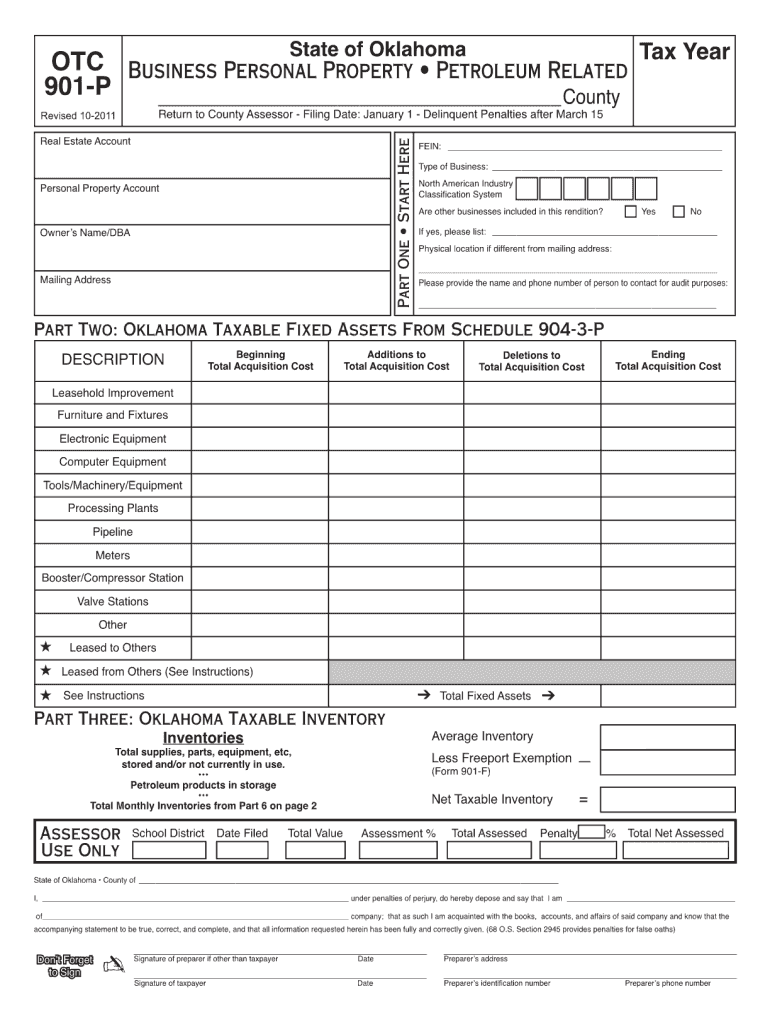

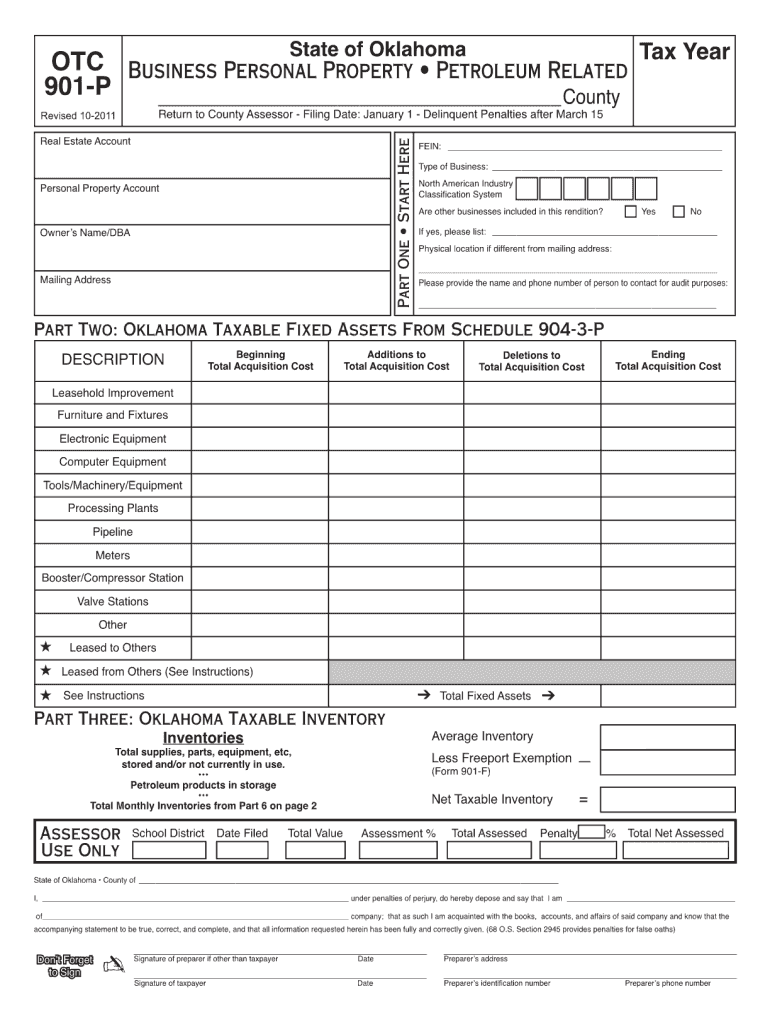

The OTC Form 901-P is the total asset reporting form for the business entity. Maps Enclose a detailed map noting the location of all taxable assets. Inventories held for others or consigned must be reported separately. Inventory which may be exempt must be claimed on the Freeport Exemption Form OTC 901-F which should be filed with the OTC Form 901-P. Taxpayers Filing Form 901-P Attach a complete detailed listing of all taxable assets grouped by d...

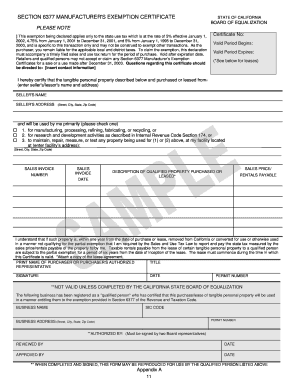

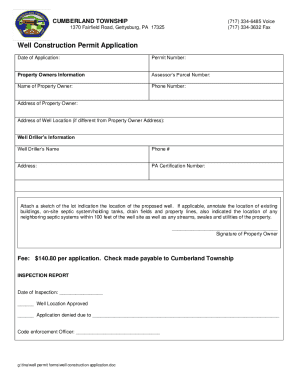

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 901 otc

Edit your otc 901 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your otc 901 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form otc 901 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form otc 901. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form otc 901

How to fill out otc 901 form?

01

Obtain the otc 901 form from the appropriate source, such as the official website of the issuing organization.

02

Read the instructions provided with the form carefully to understand the requirements and the specific information to be provided.

03

Begin filling out the form by providing your personal information, such as your name, address, and contact details.

04

Follow the instructions to enter the relevant details required for specific sections of the form, such as income information or medical history.

05

Double-check all the information provided to ensure accuracy and completeness.

06

If required, attach any supporting documents or evidence requested in the form.

07

Sign and date the completed form as instructed.

08

Submit the filled-out otc 901 form as per the guidelines provided, which may include mailing it to a designated address or submitting it online.

Who needs otc 901 form?

01

Individuals who are seeking to apply for a specific benefit or entitlement program that requires the otc 901 form may need to fill it out.

02

Certain government agencies or organizations responsible for administering benefit programs may require individuals to fill out the otc 901 form as part of the application process.

03

The otc 901 form may also be necessary for individuals who need to provide specific information or documentation related to their eligibility for certain benefits or programs.

Fill

form

: Try Risk Free

People Also Ask about

What are the requirements for Oklahoma homestead exemption?

Any person 65 years of age or older or any totally disabled person, who is head of household, was a resident of this state during the entire preceding calendar year and whose gross household income does not exceed $12,000 is qualified for the program and may apply.

What qualifies as a homestead in Oklahoma?

The homestead of any person within any city or town, owned and occupied as a residence only, or used for both residential and business purposes, shall consist of not exceeding one acre of land, to be selected by the owner.

What is the senior homestead exemption in Oklahoma?

(4) Maximum household income qualification for the Additional Homestead Exemption is $25,000.00 for all counties. (5) If age 65 or over and have been granted an Additional Homestead Exemption no application is required unless your gross household income exceeded $25,000.00.

Who is exempt from paying property taxes in Oklahoma?

The property owner must be age 65 or over as of January 1st to qualify. Gross household income from the preceding year does not exceed the 2023 maximum income qualification of $85,300. This includes income from all sources (including all persons occupying the home), except gifts.

What is a 901 form Oklahoma?

Form 901. To file a Business Statement of Assets (Form 901) with the County Assessor's office, the taxpayer completes the form listing the original cost of the assets of the business and the year the assets were acquired. Assets include: Computer equipment. Furniture and fixtures.

Do seniors get a property tax break in Oklahoma?

Senior citizens (65 and Older) earning $85,300 or less are eligible for the Senior Valuation Freeze which can reduce your property tax bill over time. This will freeze the taxable, or assessed value, of your residential property.

How do you qualify for homestead exemption in Oklahoma?

Homestead Exemption is granted to the homeowner who resides in the property on a permanent basis on January 1. The deed or other evidence of ownership must be executed on or before January 1 and filed in the County Clerk's office on or before February 1.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form otc 901 in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your form otc 901 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit form otc 901 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your form otc 901 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for the form otc 901 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your form otc 901 in minutes.

What is otc 901 form?

The OTC 901 form is a tax form used for reporting certain tax information to the state revenue department.

Who is required to file otc 901 form?

Individuals and businesses that have specific tax obligations or activity that falls under the jurisdiction of the form's requirements are required to file.

How to fill out otc 901 form?

To fill out the OTC 901 form, you should gather necessary information, accurately complete each section of the form, and follow any specific guidelines provided by the state.

What is the purpose of otc 901 form?

The purpose of the OTC 901 form is to collect necessary information for tax assessment, compliance, and record-keeping by the state revenue department.

What information must be reported on otc 901 form?

The OTC 901 form typically requires reporting of financial information, including income, deductions, and any applicable state tax obligations.

Fill out your form otc 901 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Otc 901 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.